What We Learned in August: Construction Industry Starts to Stall

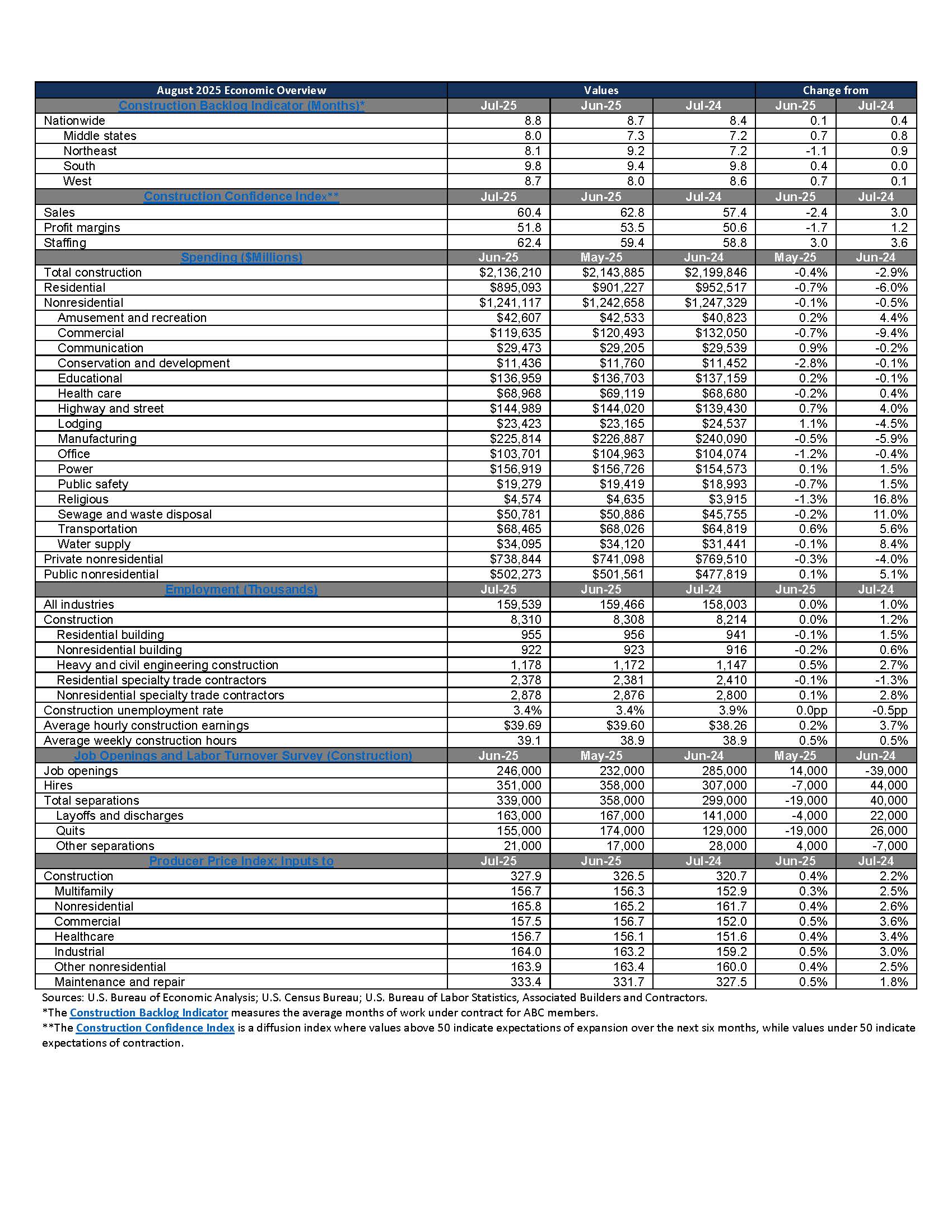

The construction industry continues to lose momentum as spending continues to fall and hiring remains sluggish. While contractor backlog is still elevated, material price escalation accelerated in July, and ongoing input cost increases have the potential to weigh on contractor profit margins over the next several months.

Nonresidential Construction Spending Falls for Sixth Time in Seven Months

Nonresidential construction spending inched lower in June and is now down 0.5% over the past year. The private sector has performed particularly poorly, with private nonresidential spending down 4.0% since June 2024. This decline would be worse if not for surging data center investment.

Input Prices Continue to Escalate

Construction input price escalation continued to accelerate in July, and nonresidential input prices have now risen at a 5.8% annualized rate during the first seven months of 2025. The effects of tariffs are beginning to surface in the data. Copper wire and cable prices, for instance, surged 5% in July and are now up 12.2% over the past year.

Overall Employment Growth Slows to a Crawl

The construction industry has added just 7,000 jobs over the past four months. While the nonresidential segment has significantly outperformed the residential segment, which has lost jobs over the past year, industrywide hiring remains extraordinarily low by historical standards.

Backlog Rebounds, Contractors Still Confident

ABC’s Construction Backlog Indicator rose to 8.8 months in July, signaling that contractors remain busy despite signs of industrywide weakness in other data series. While contractor confidence slipped in July, according to ABC’s Construction Confidence Index, ABC members remain broadly upbeat about the next six months.

Looking Ahead

With construction spending in decline, the labor market stagnant and the effects of tariffs only just beginning to surface, the industry would benefit greatly from lower borrowing costs. Unfortunately, there are signs that economywide inflation is rebounding, reducing the odds of a rate cut at the Federal Reserve’s September meeting.

SEE ALSO: IS AI STILL MISSING FROM YOUR CONSTRUCTION COMPANY’S TOOLBOX?