What We Learned in April: Construction Industry Outlook Darkens

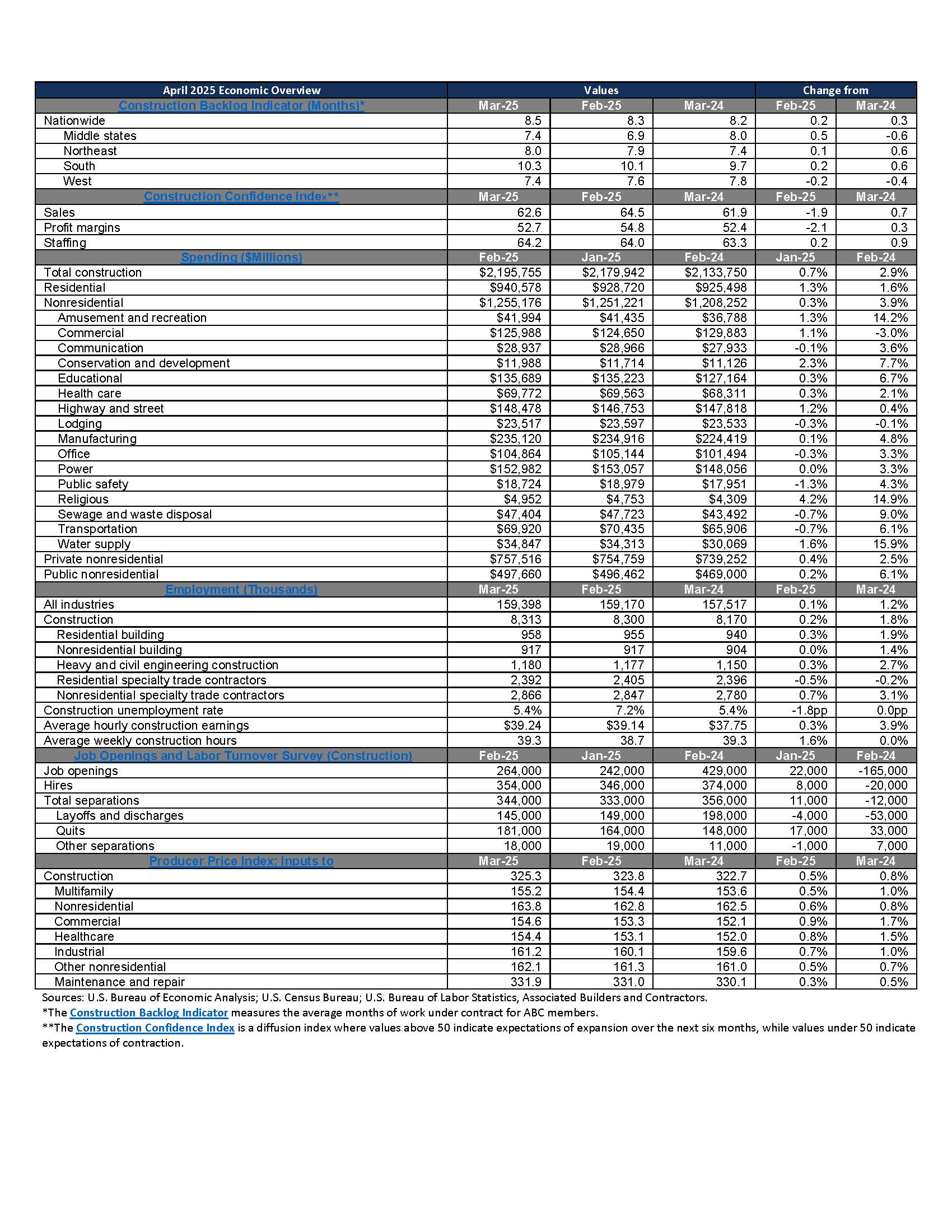

Construction-specific economic data released in April paint a somewhat upbeat picture of the industry’s recent performance. Nonresidential spending reached the highest level on record, contractors added jobs for the month and materials prices are up just 0.8% over the past year.

That high-level overview, however, obscures emerging signs of weakness in the data. More importantly, the tariffs announced on April 2, which were subsequently changed, paused, raised and lowered, have introduced unprecedented uncertainty to the outlook.

Input Costs Increase as Effects of Tariffs Begin to Surface

Construction input prices jumped another 0.5% in March and have now risen at a 9.7% annualized rate through the first quarter of 2025. Despite the fact that this data pertains to March—before the April 2 tariff announcement—previously announced and threatened import taxes had already put upward pressure on certain materials prices, with iron and steel, steel mill products, and copper wire and cable prices all rising more than 5% for the month.

Nonresidential Construction Spending Reaches All-Time High in February

Nonresidential construction spending increased 0.3% in February, rising to the highest level on record. A large portion of the monthly increase was in the highway and street category, and public nonresidential spending (+6.1% over the past year) has significantly outperformed the private nonresidential subsegment (+2.5% year over year).

Contractors Add 13,000 Jobs in March, Labor Demand Slows

Construction employment rose in March, but with downward revisions to January and February’s data, the industry added just 8,000 jobs per month during the first quarter of 2025 and is up a paltry 1.8% over the past year. Data from the Job Opening and Labor Turnover Survey show that industrywide job openings fell by 38.5%, or 165,000 positions, from February 2024 to February 2025.

Backlog Rises, Tariffs Weigh on Contractor Confidence

ABC’s Construction Backlog Indicator increased to 8.5 months in March, while contractor confidence remained elevated, albeit with slightly worse sales and profit margins expectations than in February. That said, the survey period ran from March 20 to April 6, and contractors responding after the April 2 tariff announcement actually expect their profit margins to contract over the next six months.

Looking Ahead

Professional forecasters have dramatically raised the odds of a recession in 2025 over the past few weeks. That, coupled with the expectation of rising input costs as tariffs go into effect as well as higher-for-longer interest rates, has clouded the industry’s outlook. Of course, the same trade policy unpredictability that has frozen investment decisions also means that this trade war could come to an abrupt conclusion.

SEE ALSO: